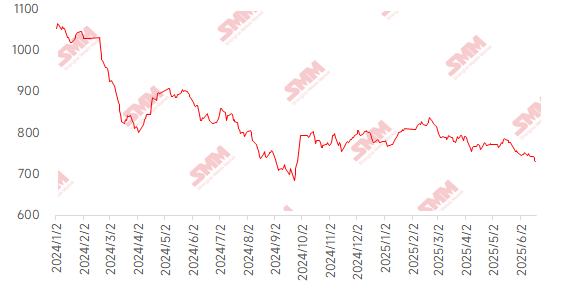

This week, imported iron ore prices initially declined before rebounding, with the price center slightly shifting downward. Fundamentally, iron ore exhibited weak supply and demand dynamics, with global shipments down 4% MoM and SMM's daily pig iron production dipping by 6,500 mt. Port inventories saw minor destocking, compounded by escalating Middle East geopolitical tensions that exerted dual market impacts: pushing up crude oil prices and raising shipping costs while simultaneously curbing Iranian resource exports, jointly supporting ore prices. However, seasonal weakening in end-use demand fostered bearish market sentiment, coupled with elevated inventories of mainstream mid-grade ores prompting traders to lower prices for sales, exerting downward pressure. Spot market-wise, Shandong port PB fines' weekly average price fell 9 yuan/mt MoM.

Chart: SMM 62% Imported Ore MMi Index

Data source: SMM

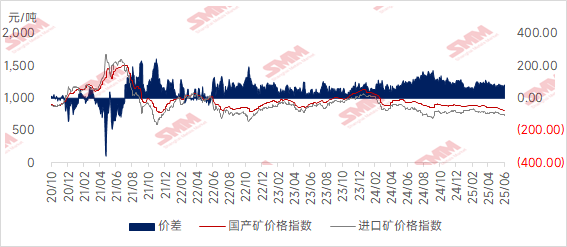

Domestic ore prices plunged this week, with narrow fluctuations anticipated next week. In Tangshan, Qian'an, and Qianxi of Hebei, prices dropped 15-20 yuan/mt, while west Liaoning, Chaoyang, Beipiao, and Jianping saw 10-15 yuan/mt declines; east China registered 5-10 yuan/mt decreases.

In Tangshan, Hebei, 66%-grade iron ore concentrates' dry-basis tax-inclusive delivery-to-factory price stood at 880-890 yuan/mt. Mines and beneficiation plants generally showed strong reluctance to budge on prices, as recent environmental inspections and mine safety checks partially disrupted operations. Though beneficiation plants faced persistent loss pressures with preexisting high shutdown rates for maintenance, actual production impact remained limited, keeping local concentrate supply tight. Demand side, most local steel mills maintained normal production per schedule, with a few planning annual maintenance. However, weak cost-performance of domestic concentrates kept mills purchasing as needed.

West Liaoning's domestic iron ore concentrate prices dipped, with 66%-grade wet-basis tax-free ex-factory prices down 10-15 yuan/mt to 680-690 yuan/mt. SMM learned a recent illegal mining accident in Chaoyang's Jianping caused casualties, prompting provincial officials to inspect the area, leading some beneficiation plants to halt again, potentially prolonging local concentrate shortages. Demand side, mills primarily purchased as needed with strong price-bargaining intentions.

East China's mines and beneficiation plants largely operated normally, though some previously faced high inventory pressure. Post-promotions, inventory pressure eased but domestic ore's weak cost-performance sustained overall sales pressure.

Chart: Imported-Domestic Ore Price Spread

Data source: SMM

Next week's outlook:

Imported ore: Iron ore market faces mixed bullish-bearish factors, likely maintaining sideways movement. From the supply side, the escalation of geopolitical conflicts in the Middle East may further push up shipping costs and curb Iran's resource exports, providing support for ore prices. Meanwhile, the quarter-end rush will drive a rebound in shipments, but rainy weather may affect port unloading efficiency, limiting the increase in port arrivals and making it difficult for port inventories to accumulate significantly. On the demand side, the early resumption of production at some steel mills' blast furnaces has driven a slight rebound in pig iron production. Coupled with the expected coke price cut, which has improved steel mill profits, short-term restocking demand is expected to continue. However, the characteristics of the off-season for end-users have emerged, with the apparent demand for the five major steel products pulling back from highs. Amidst the high production of finished steel, the market's expectation of negative feedback still exists, which will limit the upside room for ore prices. The macro perspective is in a lull, providing limited guidance to the market. Overall, iron ore prices are expected to struggle to break through on both the upside and downside and are anticipated to maintain a rangebound fluctuation. Going forward, close attention should be paid to the production rhythm of steel mills and changes in finished steel consumption.

From the perspective of domestic ore: Overall, domestic mines and beneficiation plants have a strong reluctance to budge on prices, but their cost-effectiveness is generally weak, and the overall pace of shipments has slowed down. On the demand side, steel mills are currently purchasing as needed and have a strong desire to bargain down prices. It is expected that domestic iron ore concentrates will maintain a weak and rangebound fluctuation next week.

》Click to view the SMM Metal Industry Chain Database

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)